How Do I Pay My Property Taxes In Nj . division of taxation. You can choose to pay by. pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account (e. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. New jersey's real property tax is an ad valorem tax, or a tax according. how to pay property taxes. First time paper filers are required to mail in a payment. Compare your rate to the new jersey and u.s. make a payment. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Site maintained by division of revenue and. general property tax information.

from www.uslegalforms.com

division of taxation. make a payment. New jersey's real property tax is an ad valorem tax, or a tax according. Site maintained by division of revenue and. You can choose to pay by. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. how to pay property taxes. Compare your rate to the new jersey and u.s. general property tax information.

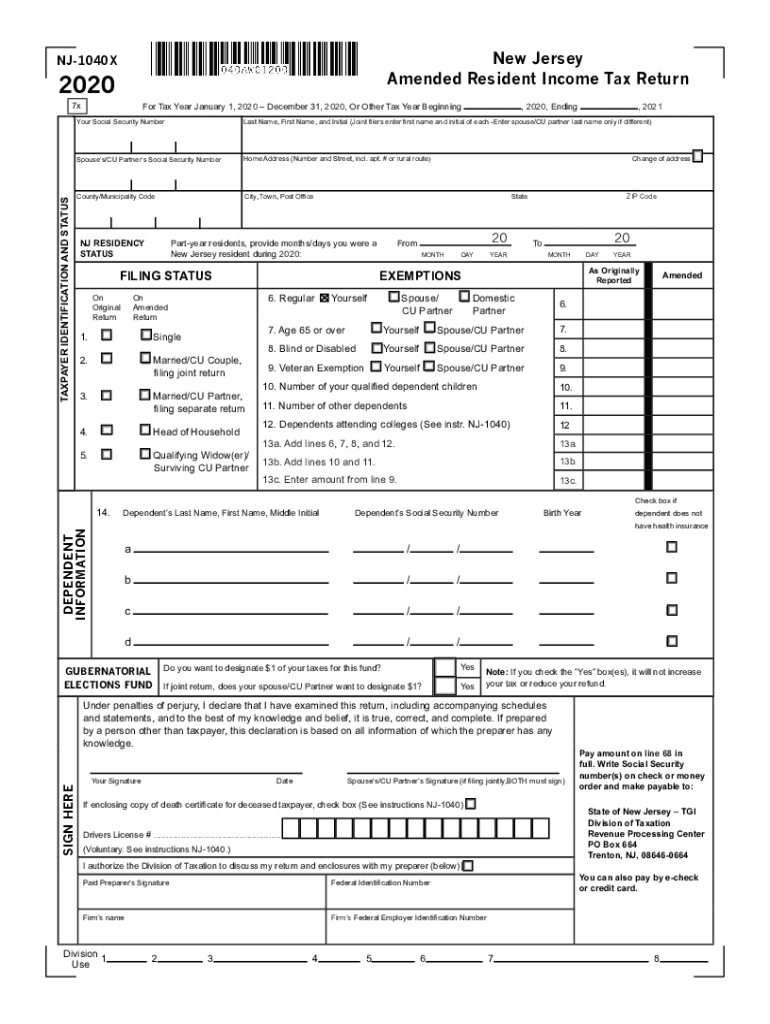

NJ DoT NJ1040x 20202022 Fill out Tax Template Online US Legal Forms

How Do I Pay My Property Taxes In Nj calculate how much you'll pay in property taxes on your home, given your location and assessed home value. division of taxation. You can choose to pay by. how to pay property taxes. Compare your rate to the new jersey and u.s. pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account (e. general property tax information. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. Site maintained by division of revenue and. First time paper filers are required to mail in a payment. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. make a payment. New jersey's real property tax is an ad valorem tax, or a tax according.

From dxohbcsgu.blob.core.windows.net

Where Can I Pay My Property Taxes Near Me at Myra Lesser blog How Do I Pay My Property Taxes In Nj New jersey's real property tax is an ad valorem tax, or a tax according. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Site maintained by division of revenue and. how to pay property taxes. First time paper filers are required to mail in a payment. division of. How Do I Pay My Property Taxes In Nj.

From www.hippo.com

Your Guide to Property Taxes Hippo How Do I Pay My Property Taxes In Nj the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. Compare your rate to the new jersey and u.s. You can choose to pay by. division of taxation. using your property assessment, your municipal tax collector uses the tax rate to issue a bill. How Do I Pay My Property Taxes In Nj.

From www.cityofmadison.com

Real Property Tax Bill Sample Property Taxes ePayment Center City How Do I Pay My Property Taxes In Nj the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. division of taxation. general property tax information. You can choose to pay by. Compare your rate to the new jersey and u.s. using your property assessment, your municipal tax collector uses the tax. How Do I Pay My Property Taxes In Nj.

From fity.club

Sample Property Tax Bills How Do I Pay My Property Taxes In Nj division of taxation. You can choose to pay by. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. general property tax information. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. First time. How Do I Pay My Property Taxes In Nj.

From dxoetjwzw.blob.core.windows.net

Do I Have To Pay Taxes On The Sale Of My Home In Virginia at Robert How Do I Pay My Property Taxes In Nj the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. New jersey's real property tax is an ad valorem tax, or a tax according. You can choose to pay by. division of taxation. Compare your rate to the new jersey and u.s. general property. How Do I Pay My Property Taxes In Nj.

From woproferty.blogspot.com

How Do I Pay My Property Taxes Online In Jamaica WOPROFERTY How Do I Pay My Property Taxes In Nj Compare your rate to the new jersey and u.s. general property tax information. First time paper filers are required to mail in a payment. division of taxation. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. how to pay property taxes. using your property assessment, your. How Do I Pay My Property Taxes In Nj.

From elsetyshelia.pages.dev

Tax Brackets 2024 Single Taxable Nara Tamera How Do I Pay My Property Taxes In Nj calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Site maintained by division of revenue and. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. using your property assessment, your municipal tax collector uses. How Do I Pay My Property Taxes In Nj.

From mentorsmoving.com

Maricopa County Property Taxes ? 2024 Ultimate Guide & What you Need to How Do I Pay My Property Taxes In Nj pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account (e. how to pay property taxes. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. First time paper filers are required to mail in a. How Do I Pay My Property Taxes In Nj.

From www.pdffiller.com

Fillable Online doc 21.docx 1. How can I pay my property taxes? There How Do I Pay My Property Taxes In Nj New jersey's real property tax is an ad valorem tax, or a tax according. division of taxation. You can choose to pay by. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. calculate how much you'll pay in property taxes on your home,. How Do I Pay My Property Taxes In Nj.

From www.nj.com

How do I pay taxes on my I Bond interest? How Do I Pay My Property Taxes In Nj make a payment. Compare your rate to the new jersey and u.s. pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account (e. general property tax information. You can choose to pay by. New jersey's real property tax is an ad valorem tax, or. How Do I Pay My Property Taxes In Nj.

From ladyarisandi.blogspot.com

33+ how to calculate nj property tax LadyArisandi How Do I Pay My Property Taxes In Nj Compare your rate to the new jersey and u.s. You can choose to pay by. general property tax information. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. pay income taxes only by credit or debit card (fee applies) or arrange for a. How Do I Pay My Property Taxes In Nj.

From dailysignal.com

How High Are Property Taxes in Your State? How Do I Pay My Property Taxes In Nj New jersey's real property tax is an ad valorem tax, or a tax according. You can choose to pay by. division of taxation. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. general property tax information. the homeowner's guide to property taxes will help your clients, constituents. How Do I Pay My Property Taxes In Nj.

From exowjvngf.blob.core.windows.net

Union City Nj Property Tax Rate at Stanley Pointer blog How Do I Pay My Property Taxes In Nj the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. make a payment. pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account (e. how to pay property taxes. First. How Do I Pay My Property Taxes In Nj.

From www.njpp.org

Road to Recovery Reforming New Jersey's Tax Code New Jersey How Do I Pay My Property Taxes In Nj using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. First time paper filers are required to mail in a payment. Site maintained by division of revenue and. New jersey's real property tax is an ad valorem tax, or a tax according. You can choose to pay by.. How Do I Pay My Property Taxes In Nj.

From www.njspotlightnews.org

Charting property taxes in New Jersey NJ Spotlight News How Do I Pay My Property Taxes In Nj the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their taxes pay for, how their taxes. You can choose to pay by. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. Compare your rate to the new jersey and. How Do I Pay My Property Taxes In Nj.

From www.nj.com

N.J.’s new ANCHOR property tax program Your questions answered How Do I Pay My Property Taxes In Nj First time paper filers are required to mail in a payment. Site maintained by division of revenue and. how to pay property taxes. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. general property tax information. New jersey's real property tax is an ad valorem. How Do I Pay My Property Taxes In Nj.

From www.uslegalforms.com

NJ DoT NJ1040x 20202022 Fill out Tax Template Online US Legal Forms How Do I Pay My Property Taxes In Nj calculate how much you'll pay in property taxes on your home, given your location and assessed home value. how to pay property taxes. First time paper filers are required to mail in a payment. You can choose to pay by. pay income taxes only by credit or debit card (fee applies) or arrange for a payment to. How Do I Pay My Property Taxes In Nj.

From morristownnj.govoffice3.com

Tax Collection Morristown, NJ How Do I Pay My Property Taxes In Nj division of taxation. using your property assessment, your municipal tax collector uses the tax rate to issue a bill for your property’s share of. general property tax information. First time paper filers are required to mail in a payment. the homeowner's guide to property taxes will help your clients, constituents and other contacts understand what their. How Do I Pay My Property Taxes In Nj.